How do businesses in Australia factor B2B payment risks into financial planning?

The majority of companies surveyed across industries in Australia report adapting their financial planning strategies in response to higher payment default risks. They are facing liquidity challenges due to rising B2B late payments and defaults amid an unpredictable economic and trading environment. Despite this, many businesses across various industries relaxed their B2B trade credit policies, offering more credit and payment flexibility to customers in order to remain competitive and sustain revenue.

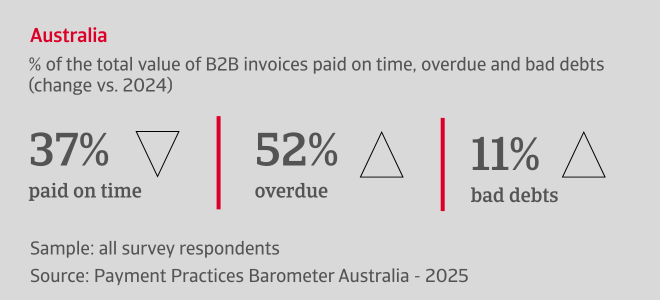

However, these adjustments led to a significant cash flow imbalance, prompting increased reliance on external financing which provides short-term relief but creates additional pressure on liquidity. Our survey findings show that more than half of B2B invoices are now overdue, largely driven by customer financial difficulties, especially in the construction industry.

What are the concerns for Australian businesses in the coming months?

The uncertain impact of the US protectionist policies on global trade is expected to pressure economic activity in Australia, complicating business and financial planning. As a result, many companies are hesitant to make firm predictions about future trends in B2B customer payment behaviour. This because highly volatile market conditions may significantly increase financial instability and the risk of late payments and defaults.

This may explain why most companies in our survey expect B2B payment patterns to remain almost unchanged in the year ahead. Businesses already facing payment risks will continue to struggle with cash flow challenges, with liquidity management remaining a concern across industries, and particularly for steel-metals companies.

The top three challenges Australian businesses are most concerned about in the coming months are rising regulatory requirements, volatile external financial costs, and economic uncertainty.

Key insights for the agri-food industry in Australia

Australian agri-food companies face growing liquidity challenges as they increase credit sales and offer longer payment terms to stay competitive despite worsening payment behaviour from B2B customers. Longer Days Sales Outstanding (DSO) impacts negatively cash flow and liquidity management, and businesses turn to invoice financing and bank borrowing to bridge working capital gaps, exposing them to higher costs and interest rate risks, potentially unsustainable in the long term.

Key industry figures and charts are provided in the report available for download below on this page.

Key insights for the construction industry in Australia

The Australian construction industry is navigating a complex financial landscape that significantly impacts liquidity management. A rise in B2B late payments, suppliers demanding faster payments, stock build-up, increased reliance on bank borrowing, and a preference for provisioning to cover credit losses, all represent sources of cash flow pressure. Combining strategic credit management, working capital and financial palnning optimization, would be essential to maintaining financial stability amid unpredictable economic times.

Key industry figures and charts are provided in the report available for download below on this page.

Key insights for the steel industry in Australia

Although B2B payment behaviour and trade credit policies remain stable in the Australian steel sector, a rise in bad debts highlight ongoing liquidity pressure. Delaying supplier payments to preserve cash flow, and relying heavily on invoice financing for quick liquidity, provides short-term relief but with additional costs. This makes a balanced credit risk management strategy, combining internal oversight with external support, vital in mitigating the risk of late payments and defaults.

Key industry figures and charts are provided in the report available for download below on this page.

Interested in finding out more?

For a complete overview of the 2025 survey results for Australia, please download the full report available in the related documents section below.

- Increase in B2B payment delays causes liquidity challenges for many companies

- Stronger focus on working capital management to ease liquidity pressure

- Switch to more proactive credit monitoring in response to cash flow challenges

- Efficient working capital management key for businesses resilience amid strong concern about costs of regulatory compliance