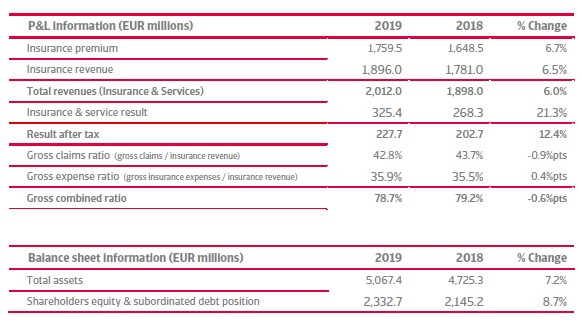

Atradius year-end result increases 12.4% to EUR 227.7 million, insurance premium rises 6.7%

- Insurance premium revenue increased 6.7% (6.1% at constant foreign exchange rates)

- Total revenue increased 6.0%, surpassing the EUR 2 billion milestone

- Result for the year increased 12.4% to EUR 227.7 million

- Gross combined ratio stable at 78.7%

- Insurance and service result at EUR 325.4 million, up 21.3%

- Shareholders’ equity and subordinated debt position improved an additional 8.7%.

- Solid solvency ratio exceeds 200% (1)

- Excellent retention of 93.4% achieved, a reflection of Atradius’ commitment to its customers and continued pursuit of excellence

(1) Subject to finalisation of any audit procedures.

Insurance revenue

Atradius’ insurance premium revenue grew 6.7% to EUR 1,759.5 million in 2019 from EUR 1,648.5 million in 2018 (6.1% at constant exchange rates). The improvement in credit insurance was stable and consistent in almost every region with Asia, UK & Ireland, Northern and Central Europe and North America along with the Global unit showing the strongest growth rates.

Claims

Atradius achieved a solid 42.8% claims ratio in 2019, as a result of fewer large claims compared to 2018.

Expenses

The expense ratio increased moderately to 35.9% in 2019 from 35.5% in 2018. This increase is the result of substantial investment in innovation and technological development aimed at further enhancing operational efficiency and customer experience.

Insurance and service result

The Atradius insurance and service result improved 21.3% to EUR 325.4 million from EUR 268.3 million in 2018.

Investment result

Atradius’ prudent investment portfolio contributed EUR 25.9 million, in a difficult environment with low or negative interest rates and volatile equity markets.

Result after tax

The result after tax increased 12.4% to EUR 227.7 million from EUR 202.7 million, reflecting the excellent insurance result for the year, driven by strong revenue growth and a stable claims ratio.

Solvency ratio

Bolstered by profitable growth in the business and stable investment returns, the Atradius

solvency ratio at the end of 2019 again exceeded 200% (1).

(1) Subject to finalisation of any audit procedures.

Business Outlook

Economic growth is expected to be more moderate in 2020 as trade policy tensions remain, weighing on global trade and economic activity. Eurozone growth will remain subdued, US growth is projected to moderate, and despite the slowdown of China, Asia will continue to be the engine of global growth. An overall worsening in the insolvency outlook, most notably in the UK and in emerging markets, should further reinforce the demand for Atradius products and services.

2019 was full of uncertainty for international trade. However, trade continued to grow and the combination created strong demand for our products and services. The outlook for 2020 looks very similar with modest growth in global GDP and an increase in insolvencies. We expect this to provide a favourable environment for continued growth in our revenues.